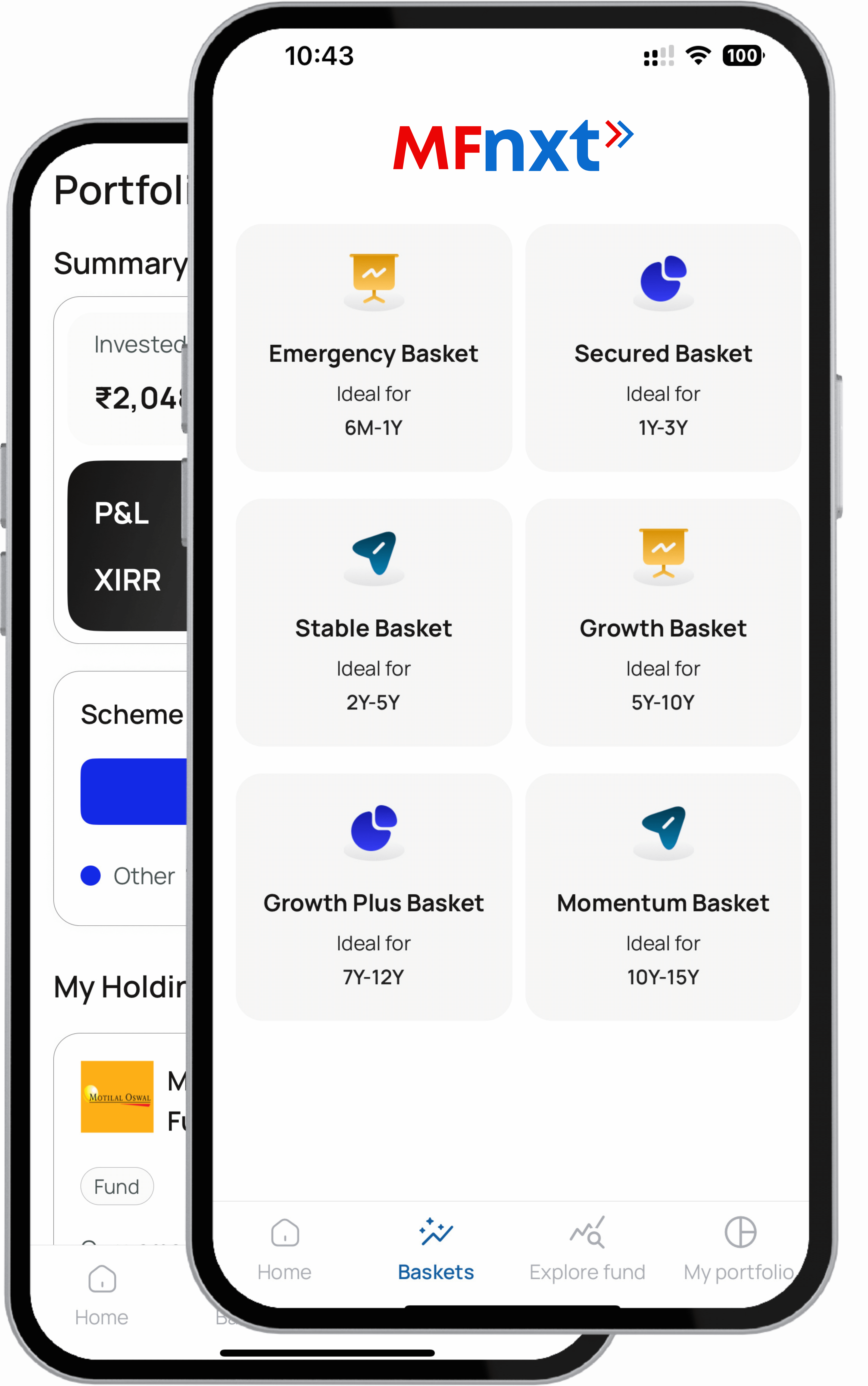

MFnxt made investing really easy for me. The app is simple to use — I started with just ₹500 and picked a basket with SIP that suited me. Now I’m watching my money grow without stress or confusion!

Index Funds Investing Simplified!

Looking for Index Funds?

You’ve Landed in the Right Place!

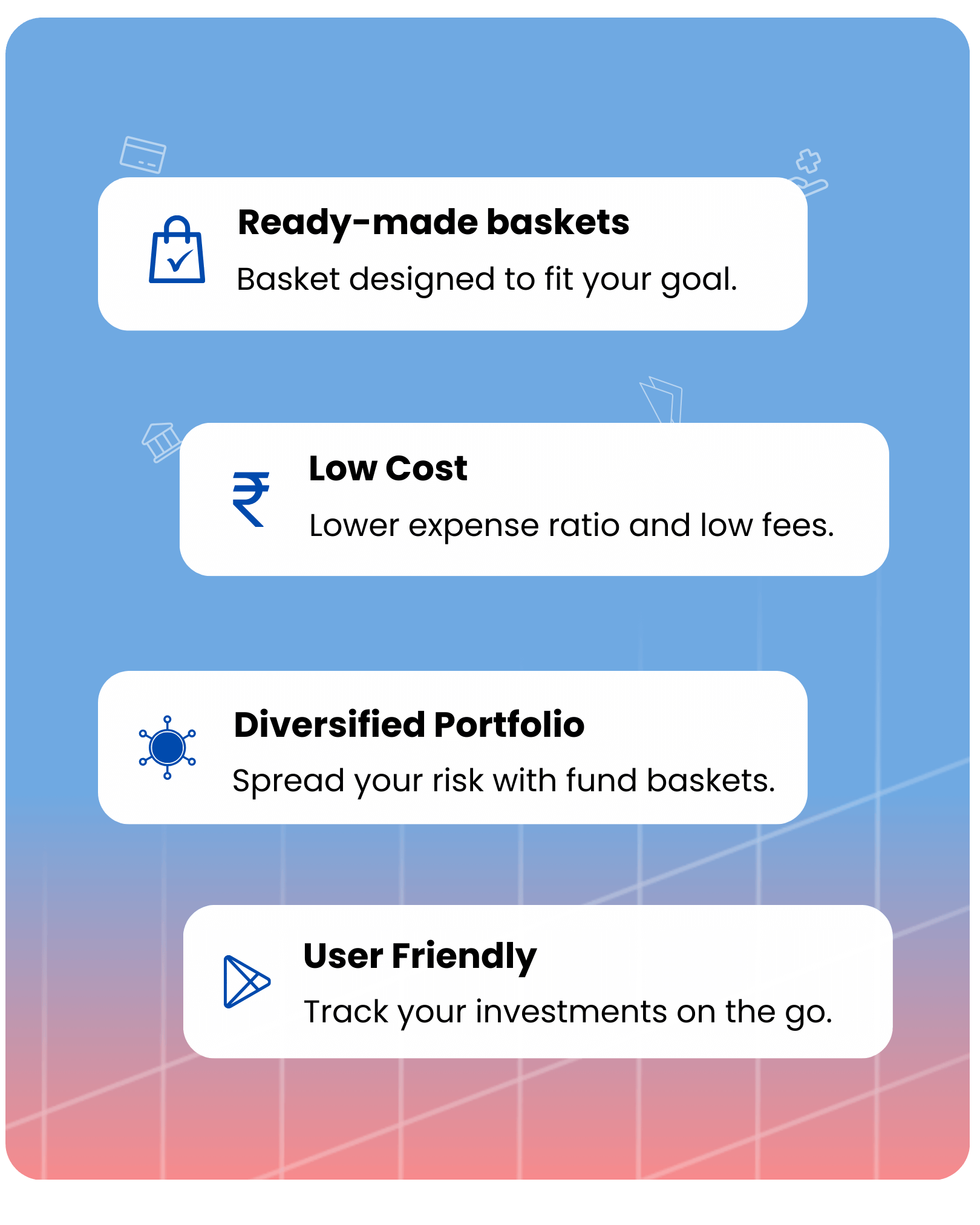

Invest in diversified index fund baskets designed for the Indian market. Build wealth systematically with our carefully curated portfolio options.

Start Your Journey Now

Open FREE Account